I agree to and consent to receive news, updates, and other communications via email from Lithium Ionic. I understand that I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from [email protected].

Lithium Ionic Announces Maiden Mineral Resource Estimate and Initiation of PEA at its Salinas Project, Minas Gerais, Brazil; Increases Regional Mineral Resources by 45%

View PDF version of this release: ENGLISH- Salinas MRE increases global resources by 45% to 47.8Mt

- M&I: 5.86Mt @ 1.09% Li2O

- Inferred 8.9Mt @ 0.97% Li2O

- ~65% of the MRE is considered open pit

- PEA for Salinas initiated; completion expected in H2 2024

- Bandeira Operational Update

- Feasibility Study to be released in May 2024

- Construction permits remain on track to be granted in early Q3 2024

TORONTO, ON, April 4, 2024 - Lithium Ionic Corp. (TSXV: LTH; OTCQX: LTHCF; FSE: H3N) (“Lithium Ionic” or the “Company”), is pleased to announce an initial NI 43-101 compliant Mineral Resource Estimate (“MRE”) for its Salinas Lithium Project (“Salinas” or the “Project”), increasing its global mineral resources by 45%. The Salinas property covers 662 hectares or ~4.5% of Lithium Ionic’s large 14,182-hectare land package within the “Lithium Valley” in Minas Gerais State, Brazil, and represents the third NI 43-101 compliant lithium MRE the Company has established to date. The “Lithium Valley” is a unique geological belt that hosts a significant concentration of lithium-bearing pegmatites, which are among the largest and highest grade in the world. The Company’s properties are located in a district that is quickly emerging as an important global lithium producer.

The MRE was prepared by GE21 Consultoria Mineral Ltda. (“GE21”) in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”).

Salinas MRE Highlights:

- Measured and Indicated (“M&I”) MRE of 5.86 million tonnes (“Mt”) at an average grade of 1.09% Li₂O, with an additional 8.90Mt of Inferred MRE grading 0.97% Li₂O, for a total of 14.76Mt.

- The MRE demonstrates rapid growth in a short timeframe. The estimate is based on 122 drill holes, or 27,030 metres, drilled between May and November 2023.

- GE21 has identified potential for significant mineral resource growth from additional lithium-rich spodumene mineralization at Salinas, including the recently discovered high-grade Noe target announced on February 6, 2024, which returned a highlight of 1.63% Li₂O over 5.60m.

- Exploration and drilling will continue at Salinas throughout 2024 with an upgraded and expanded MRE for Salinas expected in Q4 2024.

- The Salinas MRE significantly increases the Company’s consolidated, global mineral resources by 45% to 47.8Mt* with planned exploration programs at existing deposits, Salinas and Bandeira, as well as other regional targets, expected to support significant further mineral resource growth.

- GE21 has been engaged to initiate a Preliminary Economic Assessment (“PEA”) at Salinas, which is expected for completion in H2 2024 with the objective to accelerate directly to a Feasibility Study.

- The Company intends to select a suitable consultant in the near-term to initiate the permitting process and the Environmental Impact Assessment (“EIA”) study for Salinas. A target of Q1 2025 has been established for the completion of the EIA.

*See the following NI 43-101 compliant technical reports related to Lithium Ionic’s two other deposits: “Mineral Resource Estimate for Lithium Ionic, Itinga Project” (effective date of June 24, 2023; authored by Maxime Dupéré, B. Sc., P.Geo. and Faisal Sayeed, B. Sc., P.Geo.) and “Bandeira Project Araçuaí and Itinga, Minas Gerais State, Brazil” (effective date of August 30, 2023; authored by Carlos José Evangelista Silva, MSc Geo., MAIG)

Blake Hylands, P.Geo., CEO of Lithium Ionic, commented, “The initial mineral resource at Salinas marks a significant milestone for us, establishing the Project as another cornerstone asset for the Company. When we acquired the Salinas properties 12 months ago, we recognized the capacity for these claims to quickly and significantly scale our resource base, and it’s very exciting for us to see this materialize. Our exploration team is confident that the initial discoveries at Salinas are just the beginning, and the next phase of drilling is underway to reveal the full scope of the potential. While our focus remains on near-term production at Bandeira, we now have another meaningful deposit to advance in parallel.”

Carlos Costa, P.Geo., Lithium Ionic’s VP of Exploration, commented, “This maiden NI 43-101 mineral resource estimate at a third project site is a major achievement for Lithium Ionic and I am very proud of what our exploration team has accomplished in only eight months. Our efforts will continue over the next year, with a focus on significantly expanding upon the excellent foundation established at both Salinas and Bandeira. We are one of the only lithium companies in the region with large lithium deposits being delineated at multiple sites. Within our large land package in the Lithium Valley, it is our belief that we will continue to identify additional deposits over time and continue to grow our resources to a globally important scale.”

Salinas Lithium Project – Initial Mineral Resource Estimate

Strong Foundation with Outstanding Scale Potential

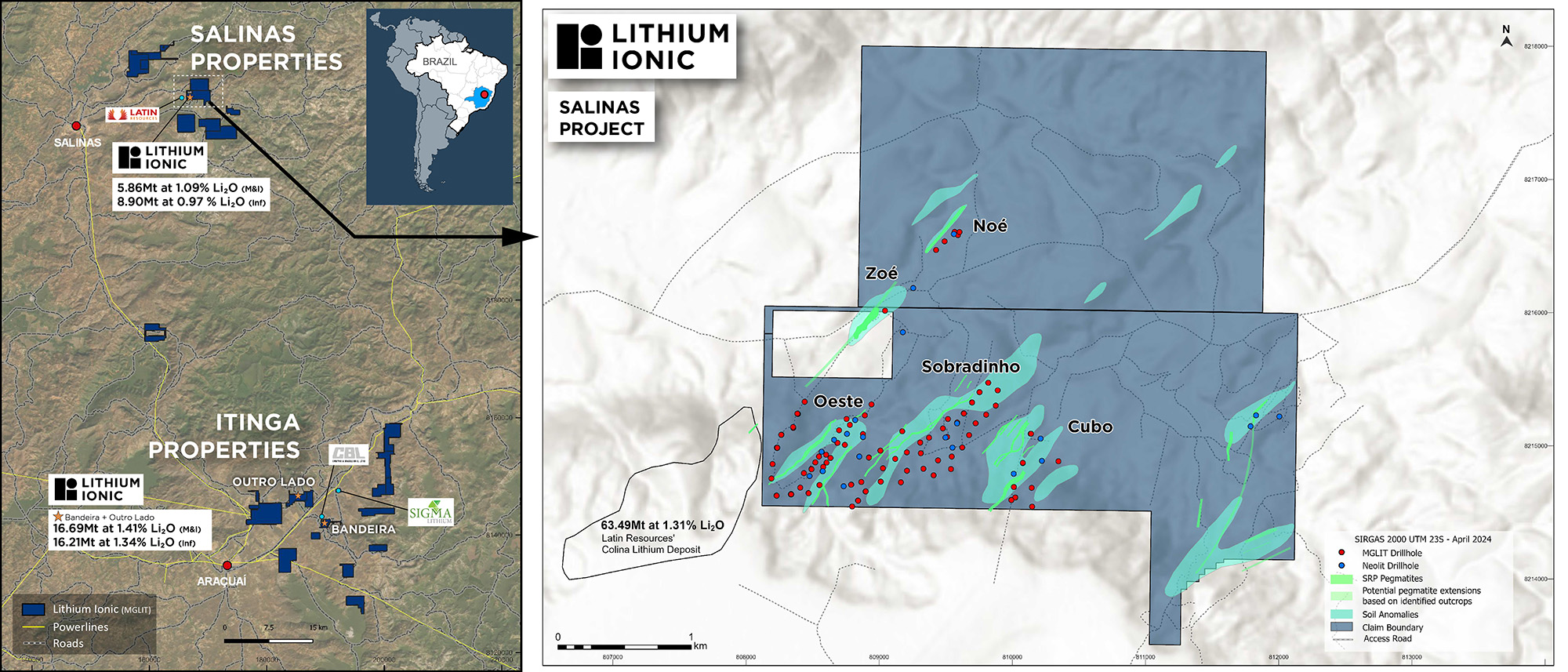

The Salinas Project is located in the lithium-rich Araçuaí Pegmatite District, in the northern part of the Eastern Brazilian Pegmatite Province, which hosts the largest lithium reserves in Brazil.

Salinas is situated approximately 100 kilometres north of the Bandeira Project where feasibility studies are being finalized, and approximately 20 kilometres east of the Salinas municipality, a town of approximately 40,000 people (see location map in Figure 1).

The Salinas MRE contain M&I resources of 5.86Mt grading 1.09% Li₂O, containing 158,678 tonnes of Lithium Carbonate Equivalent (“LCE”), the benchmark equivalent raw material used in the lithium industry, along with Inferred resources of 8.90Mt grading 0.97% Li₂O in the Inferred category, or 214,572 tonnes of LCE (see MRE results in Table 1). The MRE is based on 122 diamond drill holes comprising 27,030 metres of drilling completed between May 2023 and November 2023. An additional 24 holes (6,001 metres) have been drilled since then.

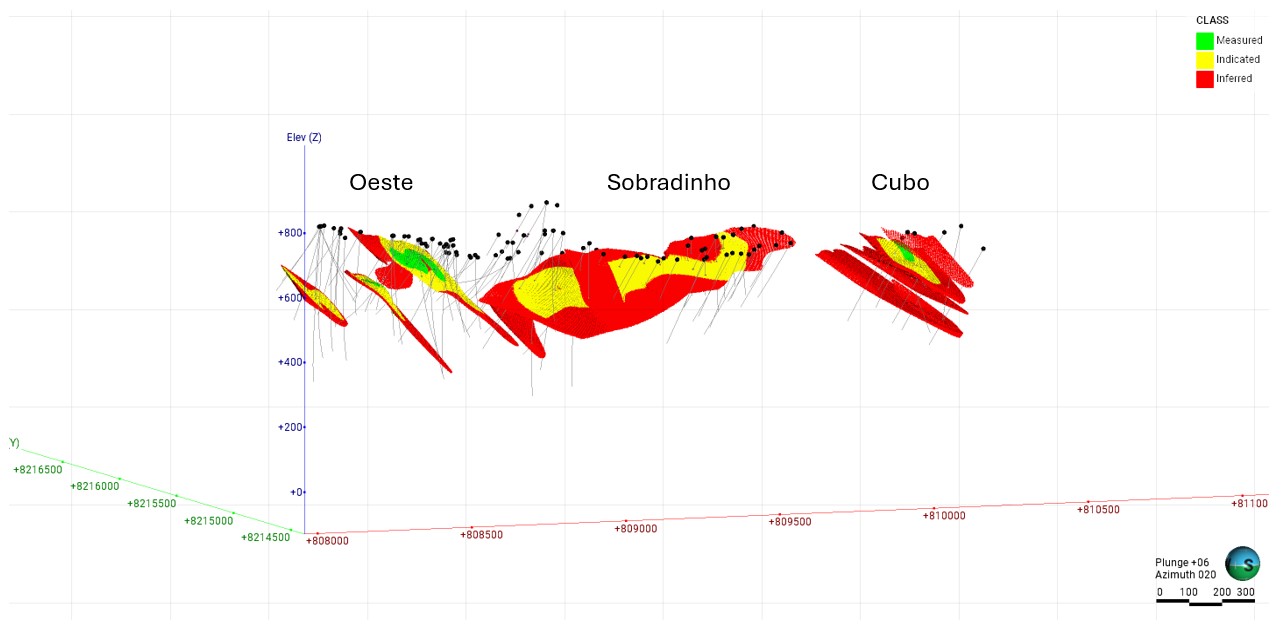

GE21 collaborated closely with the Company’s geological team to confirm the presence of a series of North-East trending moderately SE dipping pegmatite veins extending up to 1,200 meters along strike, from surface to a depth of approximately 300 meters (see isometric view of the Salinas deposit in Figure 2).

In addition to the MRE, GE21 analyzed results from drill holes located outside of the mineral resource area in the newly discovered Noé target (see Figure 1), which is believed to be the northeast extension of a large outcropping pegmatite that has been mined for spodumene intermittently for several decades called “Lavra do Zoe”. This pegmatite body is at least 15 metres thick and has a strike length of at least 210 metres.

Based on the initial drilling to date, GE21 has identified the Noé target as having strong near-term potential to further increase the MRE by between 10-15Mt with grades ranging from 1.0-1.3% Li2O following the completion of additional drilling*.

Exploration work and drilling will be ongoing at Salinas for the remainder of 2024 to continue to expand and upgrade the mineral resources. An upgraded MRE for Salinas is expected later this year.

The NI 43-101 technical report for the MRE, will be accessible on SEDAR+ (www.sedarplus.ca) under the Company’s issuer profile and the Company’s website within 45 days of this news release.

*The potential quantity and grade of the lithium mineralization at the Noé target is conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource or Reserve and it is uncertain if further exploration will confirm the target ranges.

Table 1: Salinas Mineral Resource Estimate Summary

| Deposit / Cut-Off Grade |

Category | Resource (tonnes) | Grade (% Li2O) |

Contained LCE (t) |

| Salinas Open-Pit* (0.5% cut-off) |

Measured | 940,000 | 1.22 | 28,360 |

| Indicated | 3,140,000 | 1.11 | 86,194 | |

| Measured + Indicated | 4,080,000 | 1.14 | 114,554 | |

| Inferred | 5,540,000 | 0.99 | 135,634 | |

| Salinas Underground (0.5% cut-off) |

Measured | 170,000 | 0.93 | 3,910 |

| Indicated | 1,610,000 | 1.01 | 40,213 | |

| Measured + Indicated | 1,780,000 | 1.00 | 44,123 | |

| Inferred | 3,360,000 | 0.95 | 78,938 | |

| TOTAL | Measured | 1,110,000 | 1.18 | 32,270 |

| Indicated | 4,750,000 | 1.08 | 126,407 | |

| Measured + Indicated | 5,860,000 | 1.09 | 158,678 | |

| Inferred | 8,900,000 | 0.97 | 214,572 |

(*) SR limited to 18

- The spodumene pegmatite domains were modeled using composites with Li2O grades greater than 0.3%

- The mineral resource estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

- Mineral Resources are not ore reserves and are not demonstrably economically recoverable.

- Grades reported using dry density.

- The effective date of the MRE is January 4, 2024.

- The QP responsible for the MRE is geologist Leonardo Soares (MAIG #5180).

- The MRE numbers provided have been rounded to the estimate relative precision. Values cannot be added due to rounding.

- The MRE is delimited by Lithium Ionic Baixa Grande Target Claims (ANM).

- The MRE was estimated using ordinary kriging in 16m x 16m x 4m blocks.

- The MRE report table was produced in Leapfrog Geo software.

- The reported MRE only contains fresh rock domains.

- The MRE was restricted by a pit shell using a selling price of 2750 US$/t Conc., Mining cost of 2.50 US$/ton mined, processing cost of 12.50 US$/ ton ROM and a selling cost of 112.56 US$/t conc.

Figure 1. Salinas Project Location

Figure 2. Isometric View of the Salinas Deposit

Salinas PEA Underway

Independent Brazilian consultancy, GE21 Consultoria Mineral Ltda , based in Belo Horizonte, Minas Gerais, has been engaged to carry out a PEA based on the Salinas MRE. The PEA is planned for completion in H2 2024.

Salinas Permitting process underway with EIA completion expected in 2025

The Company is in the process of selecting a suitable consultant to carry out an Environmental Impact Assessment (“EIA”) study for the Salinas property, which will contain an analysis of the Project’s potential environmental and social impacts. Following the completion of the EIA which is expected in Q1 2025, the Company can apply for the “Prior License” (“LP” or Licença Prévia in Portuguese), the first stage of the environmental licensing process for mining projects in Brazil.

Details related to the calculation of the MRE

The MRE was prepared by Leonardo Soares, P.Geo., M.Sc., of GE21 (the “Author” or “QP”) with an effective date of January 4, 2024.

The MRE was prepared using the following geological and resource block modeling parameters which are based on geological interpretations, geostatistical studies, and best practices in mineral estimation.

The QP is not aware of any factors or issues that materially affect the MRE other than normal risks faced by mining projects in the province in terms of environmental, permitting, taxation, socio-economic, marketing, and political factors, and additional risk factors regarding inferred resources.

- The Project geology comprises Neoproterozoic age sedimentary rocks of Araçuaí Orogen intruded by fertile Li-bearing pegmatites originated by fractionation of magmatic fluids from the peraluminous S-type post-tectonic granitoids of Araçuaí Orogen. Lithium mineralization is related to concordant and discordant swarms of spodumene-bearing tabular pegmatites hosted by cordierite-biotite-quartz schists.

- Drilling conducted by Lithium Ionic included diamond core drilling of NTW (64.2mm diameter).

- Diamond core has been sampled in intervals of ~ 1 m where possible, otherwise intervals less than 1 m have been selected based on geological boundaries. Geological boundaries have not been crossed by sample intervals. ½ core samples have been collected and submitted for analysis, with regular field duplicate samples collected and submitted for QA/QC analysis.

- Drill core samples were submitted to SGS Geosol laboratories in Brazil where they were analyzed for a 31-element suite via ICP90A (fusion by sodium peroxide and finish with ICP- MS/ICP-OES). Assay data were composited to 1 m.

- The MRE was estimated from the diamond drill holes completed by Lithium Ionic from May 2023 until November 2023. Data from a total of 122 drill holes comprising 3,276 assays were included in the mineral resources model.

- The 3D modelling of lithium Mineral Resources was conducted using a minimum cut-off grade of 0.3% Li2O within a preliminary lithological model.

- The interpolation was conducted using Krigging methodology with three interpolation passes.

- The block model was defined by a block size of 5 m long by 5 m wide by 5 m thick and covers a strike length of approximately 1,200 m to a maximal vertical depth of 300 m below surface.

- The MRE was classified as Measured, Indicated and Inferred Mineral Resource based on data quality, sample spacing, and pegmatite continuity. The Measured Mineral Resource was defined using a search ellipsoid of 50 m by 50 m by 30 m, and where the continuity and predictability of the mineralized units was reasonable. The Indicated Mineral Resource was defined using a search ellipsoid 100 m by 100 m by 50 m. The Inferred Mineral Resource was assigned to areas where drill hole spacing was greater than 100 m by 100 m by 50 m for all remaining blocks.

- Classification focused on spatial relation using a minimum of five composites in at least three different drill holes for the Measured and Indicated resources.

- Validation has proven that the block model fairly reflects the underlying data inputs. Variability over distance is relatively moderate to low for this deposit type therefore the maximum classification level is Indicated.

- Mineralization at the deposits extends to surface and is expected to be suitable for open cut mining; no minimum mining width was applied; internal mining dilution is limited to internal barren pegmatite and/or host rock intervals within the mineralized pegmatite intervals; based on these assumptions, it is considered that there are no mining factors which are likely to affect the assumption that the deposit has reasonable prospects for eventual economic extraction.

- It is the QP’s opinion that the current classification used is adequate and reliable for this type of mineralization and MRE.

- Initial Metallurgical tests results are not available at this stage of project advancement. An assumed concentrate (DMS) recovery of 65% has been applied in determining reasonable prospects of eventual economic extraction.

- Mineral Resources were constrained within the boundaries of an optimized pit shell using the following constraints: Concentrate price: USD$2,750; mining costs: USD$2.5/t ROM; Processing costs: USD$12.5/t ROM, General/Admin: USD$4.0/t ROM, Lithium Recovery: 65%, Mining Recovery: 95% and Pit slope: 60°.

- The MRE reported is a global estimate with reasonable prospects of eventual economic extraction.

Bandeira Feasibility Study Update

A Feasibility Study for Bandeira is currently being finalized by AtkinsRéalis (formerly SNC-Lavalin). Results were recently presented to the Company, which were in line with guidance and expectations, however certain aspects of the study require additional work to meet the standard of accuracy expected at a feasibility level study. Further detail is being developed on installed equipment costs to ensure the capital estimate meets a level of precision suitable for project financing. While the CAPEX of the Project is not expected to be materially different from the PEA results, this additional work will increase the certainty of the economic model and better support the transition to the execution phase of the project. AtkinsRéalis has indicated that they require approximately 4-6 weeks from today’s date to complete this additional work. The Company is capitalizing on this additional time to complete further metallurgical process tests to optimize dense media recoveries. Losses associated with fines during the crushing stage are typical in DMS (Dense Media Separation) circuits, however the Company is exploring solutions to maximize the recoveries of these fines to further enhance the project. The completion of the Feasibility Study is now expected in May 2024.

Helio Diniz, President of Lithium Ionic, commented, “The Feasibility Study is nearing completion, with results aligning closely with our expectations and projections. Our current focus is on ensuring that the quality and level of detail of the study meets our expected standard, while also exploring every avenue for project optimization before advancing to the next stages of development. We are confident that this diligent work will result in a highly accurate and reliable study that will support a seamless transition to the execution phase of the project.”

Bandeira Environmental Licence On-Track

The review of the Concomitant Environmental and Installation License (“LAC”, or Licença Ambiental Concomitante in Portuguese) application for the Bandeira Project is well underway by the Minas Gerais State Department of Environment and Sustainable Development ("SEMAD”). Since submitting the application in November 2023 (see press release dated November 21, 2023), Lithium Ionic has engaged in productive discussions with SEMAD, during which no significant concerns or issues were highlighted. The license is expected to be granted in early Q3 2024, aligning with our projected timeline.

On behalf of the Board of Directors of Lithium Ionic Corp.

Blake Hylands

Chief Executive Officer, Director

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its flagship Itinga and Salinas projects cover 14,182 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. The Itinga Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Qualified Persons

Leonardo Soares, P.Geo., M.Sc., of GE21 is a Qualified Person as defined by NI 43-101 And has reviewed and approved the technical information and data regarding the MRE included in this news release. Mr. Soares is independent of Lithium Ionic. All other scientific and technical information in this news release has been prepared by Carlos Costa, Vice President Exploration of Lithium Ionic and Blake Hylands, CEO and director of Lithium Ionic, and both are “qualified persons” as defined in NI 43-101.

Investor and Media Inquiries:

+1 647.316.2500

[email protected]

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute “forward-statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the prospectivity of the Company’s mineral properties including Salinas and Bandeira, the Company’s ability to produce a NI 43-101 compliant mineral resource estimate, PEA and/or Feasibility study and the timing thereof, the Company’s ability to obtain the requisite licences and permits, the economic viability of the Bandeira project, the Company’s ability to obtain adequate financing, the mineralization and development of the Company’s mineral properties, the Company’s exploration program and other mining projects and prospects thereof and the Company’s future plans. Such statements and information reflect the current view of the Company. Risks and uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Information and links in this press release relating to other mineral resource companies are from their sources believed to be reliable, but that have not been independently verified by the Company.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.